We’ve waded through the details of the 2019 Federal Budget to find and pass on to you the tax and superannuation measures that we believe are the most important to and your business.

Unlike recent years, there’s not a great deal of changes in the Federal Budget in these areas. With a Federal election looming it is important to remember that all these measures are reliant on the relevant legislation passing Parliament.

Business

Instant asset write-off increased to $30K and expanded to businesses with turnover under $50M

The threshold for the popular $20,000 instant asset write-off will increase to $30,000* from Budget night until 30 June 2020 (when it will potentially return to its original $1,000 level on 1 July 2020)

In addition, the number of businesses that can access the instant asset write-off will increase. Currently, to qualify for the write-off, only businesses with an aggregated turnover under $10 million qualify. From Budget night, businesses with an aggregated turnover under $50 million will also be able to access the write-off.

Remember, this initiative is subject to the passage of legislation so don’t go out on a spending spree just yet!

* $30,000 exclusive of GST for GST registered businesses. $30,000 inclusive of GST for businesses not registered for GST.

Individuals

Personal income tax cuts

There are some immediate tax cuts for those on low and middle incomes, through an increase to the Low and Middle Income Tax Offset (LMITO).

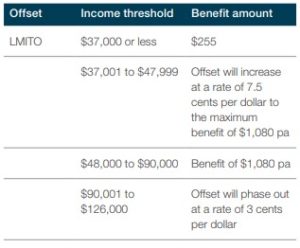

The LMITO will provide a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. Between taxable incomes of $37,000 and $48,000, the value of the offset will increase at a rate of 7.5 cents per dollar to the maximum offset of $1,080. Taxpayers with taxable incomes between $48,000 and $90,000 will be eligible for the maximum offset of $1,080. From taxable incomes of $90,000 to $126,000 the offset will phase out at a rate of 3 cents per dollar.

The LMITO is received after you have lodged your tax return.

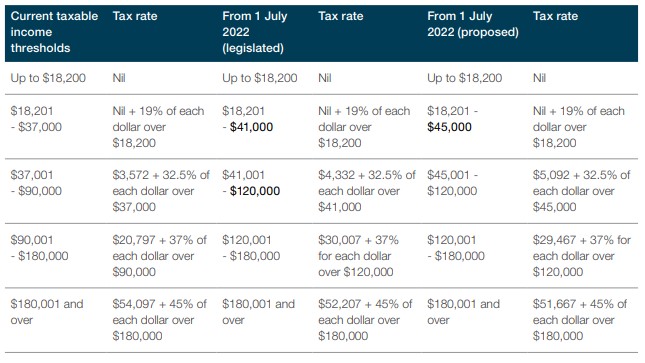

However, the next changes to the personal income tax brackets are not to take effect until 1 July 2022, when the upper range of the 19% tax bracket increases from $37,000 to $45,000, and the upper range of the 32.5% tax bracket increases from $90,000 to $120,000. That’s three years away (or three or more Prime Ministers away) so anything can happen between now and then.

Superannuation

Superannuation work test watered down and age limit for spouse contributions increased

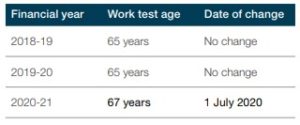

From 1 July 2020, those aged 65 and 66 will be able to make voluntary superannuation contributions (concessional and non-concessional) without meeting the Work Test. Currently, voluntary contributions can only be made if the individual has worked a minimum of 40 hours over a 30-day period (Work Test).

Those aged 65 and 66 will also be able to make up to three years of non-concessional contributions under the bring-forward rule ($300,000 under the current rules).

In addition, the age limit for spouse contributions will be increased from 69 to 74 years. Currently, those aged 70 years and over cannot receive contributions made by another person on their behalf.

Compliance

Extra $1B in funding to the ATO to tackle large corporates and high net wealth individuals

The Government will provide $1bn over four years from 2019-20 to the ATO to extend the operation of the Tax Avoidance Taskforce and to expand the Taskforce’s programs and market coverage. For this, the ATO is expected to produce a $3.6bn budget gain.

Tax avoidance schemes and strategies are the focus of this funding.

In addition to the above, a new dedicated sham contracting unit will be created within the Fair Work Ombudsman. The unit’s role is to address sham contracting behaviour by some employers, particularly those who knowingly or recklessly misrepresent employment relationships as independent contracts to avoid statutory obligations and employment entitlement.